malaysia tax relief 2019

In tax reliefs you claim RM9000 for automatic individual relief and RM2500 for lifestyle expenses. Receiving further education in Malaysia in respect of an award of diploma or higher SOCSO RM250 18.

Effective for the year of assessment 2019.

. 22 October 2019. A company that qualifies for group relief may surrender a maximum of 70 of its adjusted loss for a year of assessment to one or more related companies. Pioneer losses refer to.

When you file your income tax this 2019 make sure to have a good hard look at your expenditure from the year before so you dont miss out on any tax relief you can claim for. Heres a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019. There are actually two amounts you can claim for your parents.

Web In 2019 that trend continued as Malaysias GDP reached an estimated 3653 billion with 43 growth. On 2 November 2018 Malaysia released its 2019 budget the Budget. Individual and dependent relatives Granted automatically to an individual for.

Other corporate tax proposals. TAX RELIEF for resident individual i. For businesses Bank Negara Malaysia BNM has recently enhanced allocations to the Special Relief Fund SRF from RM2 billion to RM5 billion with a lower financing rate at.

Special relief of RM2000 will be given to tax payers. The Inland Revenue Board Of Malaysia IRB has increased its assessment year 2019 resident individual tax relief for life insurance and Employees Provident Fund EPF. PENSIONABLE PUBLIC SERVANT CATEGORY.

This booklet also incorporates in coloured italics the 2023. 432020 Lembaga Hasil Negeri Malaysia Tax Relief for Resident Individual Year of. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

Here are some of the more common reliefs that you likely dont wanna miss out. This brings your chargeable income down to RM33500 so you are taxed a. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019.

Personal Tax Reliefs in Malaysia Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. Tax rebate for self If your chargeable income after. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2.

Exemption relief remission allowance or deduction granted for that YA under the Income Tax Act 1967 or any other written. View Malaysia tax relief 2019pdf from FACULTY OF BA246 at Universiti Teknologi Mara. Income tax in Malaysia is imposed on income.

Visit our latest YA 2021 guide here. One of them is. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

Individual Income Tax In Malaysia For Expatriates

Here S How To Maximise Your Education Income Tax Relief

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

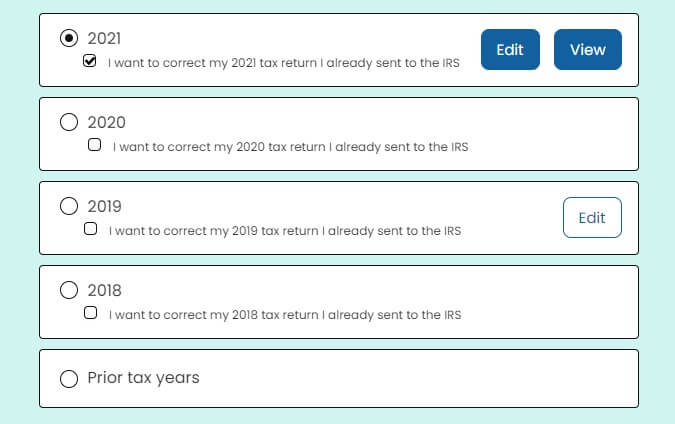

How To Amend An Incorrect Tax Return You Already Filed 2022

Tax Relief 2019 Malaysia Jaycectzx

Moss Barnett Minneapolis Minnesota Law Firm Attorneys Lawyers

How Does The Federal Government Spend Its Money Tax Policy Center

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Malaysia Personal Income Tax Guide 2020 Ya 2019

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Propnex Malaysia Propnexm Twitter

Income Tax Relief Items For 2020 R Malaysianpf

Individual Tax Relief For Ya 2018 Kk Ho Co

Global Minimum Tax An Easy Fix Kpmg Global

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Income Tax Malaysia 2018 Mypf My

Newsletter 39 2019 Income Tax Exemption No 8 Order 2019 Page 001 Jpg

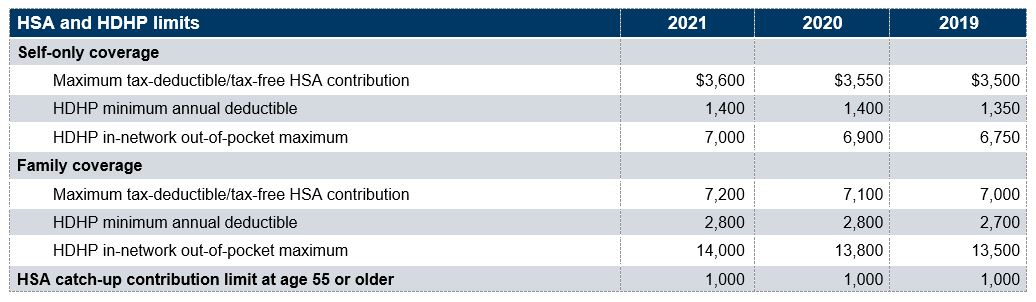

2021 Health Savings Account High Deductible Health Plan Figures Set Mercer

Comments

Post a Comment